Unlock exclusive digital tools with free lifetime access

Get instant access to premium software & tools. No login hassles, no hidden fees — just sign in and go.

Get instant access to premium software & tools. No login hassles, no hidden fees — just sign in and go.

Four powerful modules working together seamlessly in one app. Stop switching between tools.

Track income, expenses & M-Pesa debts.

Professional invoices & receipts.

Stock tracking & low-stock alerts.

Fast checkout with cart & M-Pesa.

Take full control of your transport business with Kenya's smartest fleet management system. Stop guessing which vehicles make money and which drain your profits. FleetTrack gives you real-time insights into every shilling coming in and going out. What you get - Fleet Pulse Dashboard See all vehicles at a glance - Active, In Service, Grounded - Profit per Vehicle Know exactly which car is your top earner and which is a liability - 30-Second Daily Logging Quickly log collections and expenses with big, thumb-friendly buttons - Smart Service Alerts Never miss an oil change - get warned before service is due - Expense Breakdown Track Fuel, Kanjo, Police, Car Wash, and more separately - Driver Performance See which drivers bring in the most and cost you the least - Cash Flow Pulse Compare Income vs Expenses at a glance - Mobile-First Design Works perfectly on your phone at the stage or parking lot Built for - Boda Boda Fleet Owners - Uber & Bolt Fleet Managers - Taxi Companies (Sacco Fleets) - Delivery & Courier Services - Matatu Owners - Any Multi-Vehicle Business Stop using notebooks and WhatsApp groups. Start running your fleet like a real business.

FREE

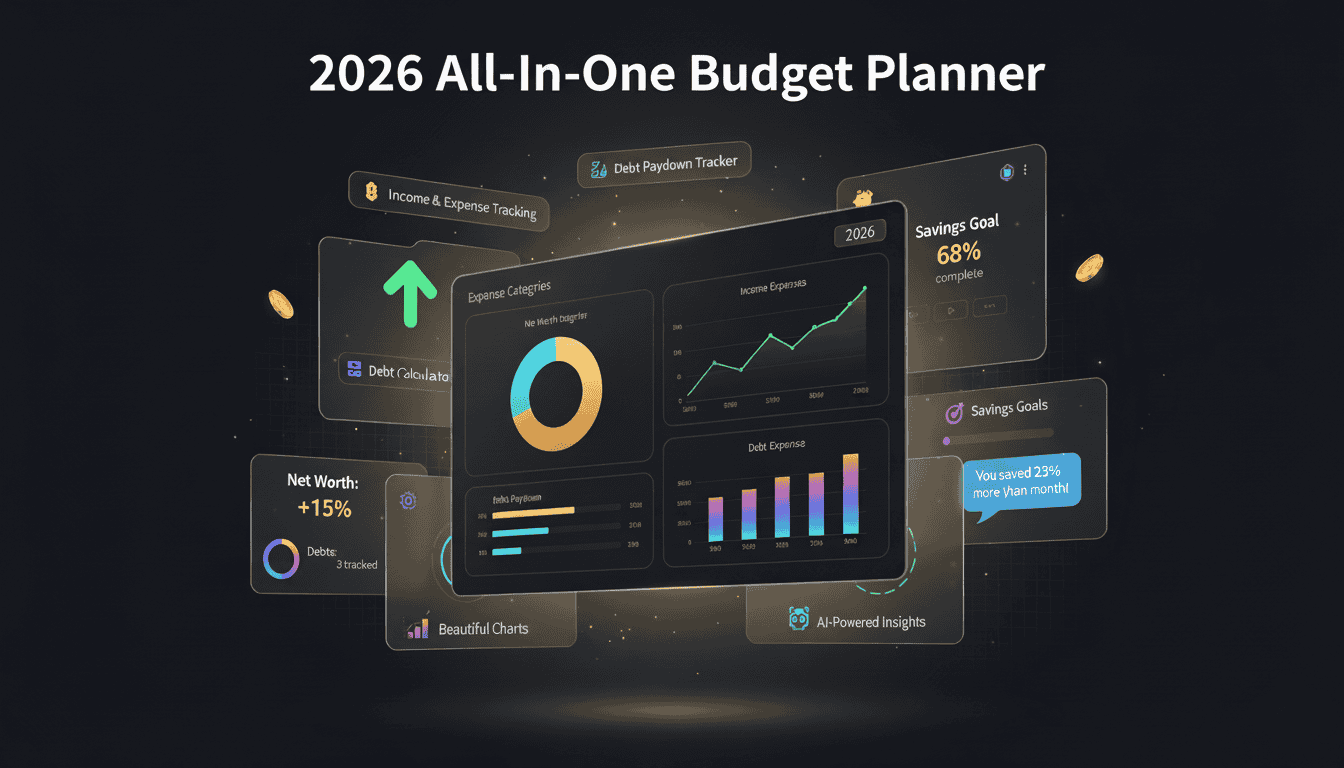

The ultimate financial operating system for your life. Track Net Worth, Pay Down Debt, and Plan for the Future with AI-powered insights. What you get - Complete Expense & Income Tracking - Net Worth & Debt Payoff Calculators - AI Financial Advisor Integration - Unlimited Goal Tracking - Secure Cloud Sync

FREEJoin thousands of Kenyan entrepreneurs who've ditched Excel, notebooks, and WhatsApp chaos for tools that actually work.

Stop wasting hours on Excel. Upload PDFs, CSVs, or let AI auto-fill your data. Generate receipts and share them on WhatsApp - all from one dashboard.

Your data lives in the cloud. Open your dashboard from your phone at the shop, laptop at home, or tablet on the go. Always in sync.

No app store needed. Add our tools to your home screen with one tap. Works offline, launches instantly - feels native on any phone.

Every product is powered by Gemini AI. Get smart suggestions, automated reports, and insights that help you make better business decisions.

Buy once, benefit forever. We constantly improve our tools based on real user feedback. New features land automatically - no extra cost.

Need something unique for your business? We build custom solutions tailored to your exact workflow.

Get a QuoteTrusted by business owners across Kenya